Many on Wall Street are waiting to see who wins the Super Bowl this Sunday.

That’s because they believe in the well-known “Super Bowl Indicator,” which says the U.S. stock market will rise for the year so long as the game’s winning team was never a part of the original American Football League (now the American Football Conference), or was in the NFL prior to the AFL’s 1966 merger with the National Football League.

For 2024, that means the market will be higher if the San Francisco 49ers win, and fall if the Kansas City Chiefs come out on top.

Despite many claims that this predictor has an impressive record, its success rate in fact is worse than a coin flip. But don’t take my word for it: The person who came up with the Super Bowl Indicator said he created it as a joke, and was embarrassed that so many on Wall Street began focusing on it.

I’m referring to Leonard Koppett, a sportswriter and a member of the Baseball Hall of Fame. As far as my reconstruction of events has been able to determine, Koppett first mentioned the Super Bowl Indicator in the Sporting News sports magazine in February 1978. It was quickly publicized on Wall Street by William LeFevre, editor of an investment newsletter called the Monday Morning Market Memo, and, in turn, by Robert Stovall, who at the time was president of Stovall Twenty First Advisors.

The gold standard when testing a predictor such as this is measuring its success after it was first discovered. That’s because it’s all too easy, when combing through historical data, to discover patterns that appear to have uncanny accuracy, but which are totally spurious. Examples that I’ve written about before include correlations between the S&P 500

SPX

on the one hand and, on the other, butter production in Bangladesh or the amount of buried treasure discovered off the coast of England and Wales.

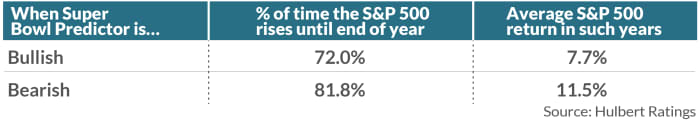

The table below summarizes the results of this out-of-sample testing for the Super Bowl Indicator, beginning in 1978. As you can see, the stock market on average has actually performed better when the indicator is bearish.

No wonder that, shortly before Koppett died in 2003, he reportedly said that he hoped the Super Bowl Indicator would be declared “dead as a doornail.”

The broader lesson here is the importance of subjecting every apparent stock-market pattern to out-of-sample testing. This is essential not only for believers in the Super Bowl Indicator, but for financial academics as well.

In fact, according to Campbell Harvey, a Duke University finance professor, there is a “replication crisis” in academic finance. He reached this conclusion after studying the out-of-sample performance of some 400 strategies that prior academic research had claimed could beat the market — and finding that at least half of them are bogus.

The bottom line: Enjoy the big game without concern for what it might mean for the stock market.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Super Bowl squares pool: Is there a winning strategy?

Plus: ‘Undeniable’ Taylor Swift connection: Health and beauty brands are buying pricey Super Bowl ads