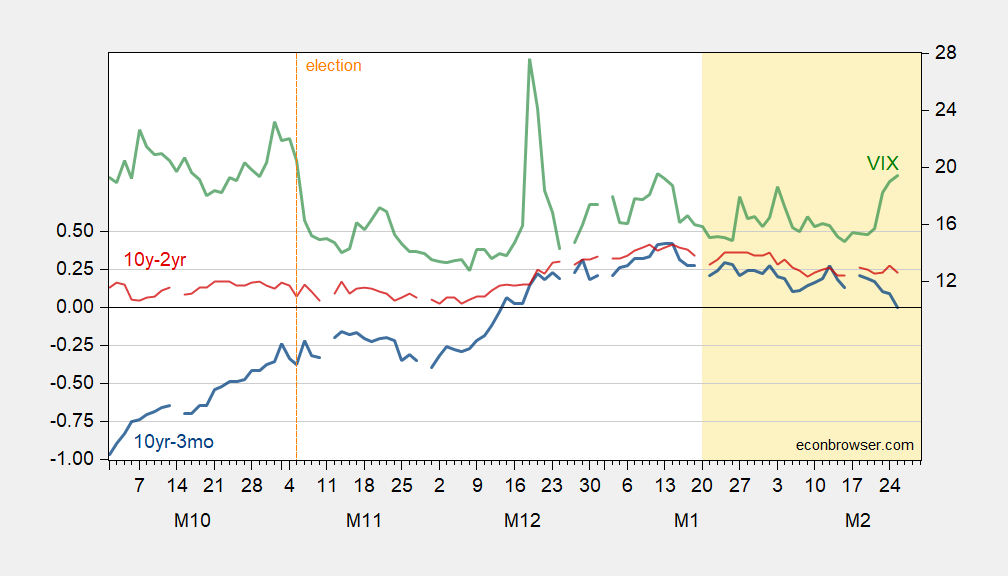

As of today’s close, the constant maturity 10yr-3mo spread is … 0%.

Figure 1: 10yr-3mo Treasury spread (blue, left scale), 10yr-2yr Treasury spread (red, left scale), both in %; VIX at close (green, right scale). Source: Treasury, CBOE via FRED.

In the wake of the term spreads failure (so far) to predict the recession of 2024-25, I’m not sure what to make of this. However, when combined with the measured collapse in expectations registered in the U.Michigan and Conference Board surveys, this all hints at a fast deterioration in perceived economic trajectory.