Today we are pleased to present a guest contribution by Jamel Saadaoui (University of Strasbourg).

Commerce is a cure for the most destructive prejudices…wherever we find agreeable manners, there commerce flourishes; and that wherever there is commerce, there we meet with agreeable manners.

When two nations come into contact with one another, they either fight or trade. If they fight, both lose; if they trade, both gain.

Peace is the natural effect of trade. Two nations who traffic with each other become reciprocally dependent…their union is founded on their mutual necessities.

Montesquieu, The Spirit of Laws, 1748

In these couple of quotes, we can easily understand that the French Philosopher Montesquieu (Charles Louis de Secondat, of his real name, born in 1689 and died in 1755) had a positive view on the effect of commerce and trade on the political relationships between two nations. Maybe it was true at his time. Related to this question, Menzie Chinn recently wrote here on the trade relationships of Germany before World War I. Maybe, increasing trade is not always a good predictor of peaceful relationships. Montesquieu may be wrong.

An interesting question would be to test the case of China, its emergence has not been fully understood at the beginning of the 1990s (see here), expect the business community which was well aware of the huge consequences of China’s takeoff. After the entrance of China into the WTO on December 2001, the place of China in world trade has become increasingly important. This trend was continued until the Global Financial Crisis (GFC). Did this expansion of trade for China cause more peaceful relationships with its trade partners during the last 60 years?

Antonio Afonso, Valérie Mignon, and I investigate this question in a recent working paper. In order to answer this question with some empirical evidence and not rely only on intuitions, we need three ingredients, namely, (1) variables that measure trade linkages, (2) variables that measures bilateral political tensions, and (3) statistical tests that allow for time-varying causality. For the trade linkages, we use the current account balance (to include the income balance) and the bilateral exchange rate with the US dollar (the dollar remains dominant in trade; see here). For the bilateral political tensions, we use the Political Relationship Index (PRI) built and mainting by Xuetong Yan and its team at Tsinghua University (see here). For time-varying non-causality tests, we rely on the test developed by Shi et al. (2020). We will focus on important trade partners of China, namely, the US, the UK, and Germany. We also look at three important tarde partners, India, Japan, and South Korea.

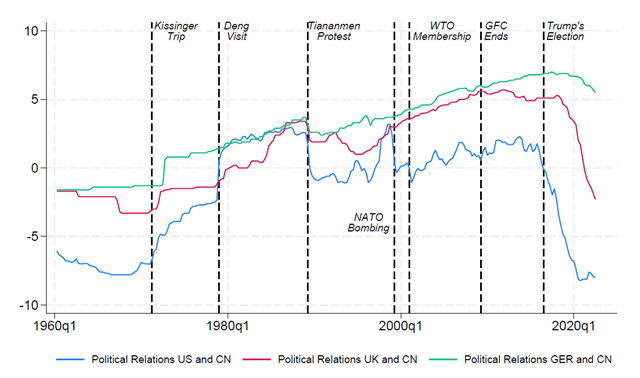

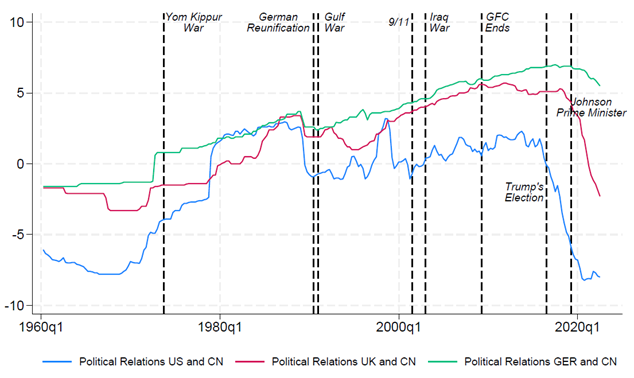

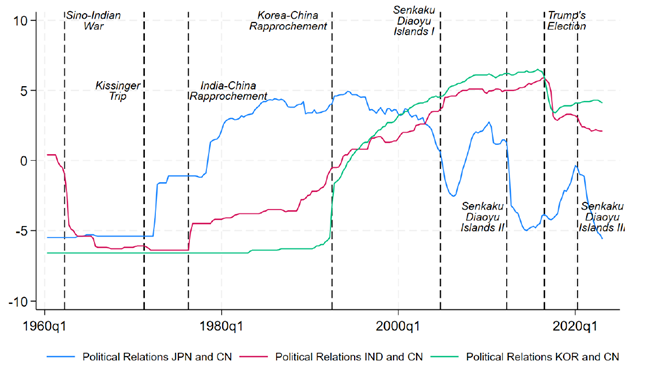

At this point, one may wonder about the quality of the PRI to measure bilateral political tensions. In the following Figures 1 to 3, you will see that the fluctuations around the main events are regularly reproduced.

Figure 1: Bilateral Political Relationship Indices (PRI): Highlighting US-China events

Figure 2: Bilateral Political Relationship Indices (PRI): Highlighting Europe-China Events

Figure 3: Bilateral Political Relationship Indices (PRI): Highlighting Asia-China Events

If you are sufficiently convinced that these indexes are reliable, we can turn now to the time-varying noncausality test between trade linkages and political tension to answer our question. In the paper, we use an alternative measure of political, namely, the ideal point distance to China in the UN General Assembly votes (see here), as a robustness check. For the bilateral exchange rates, we also add in the lag-augmented VAR, the GPR index of Caladara and Iacoviello, and the VIX, as these two variables may influence the bilateral exchange rate.

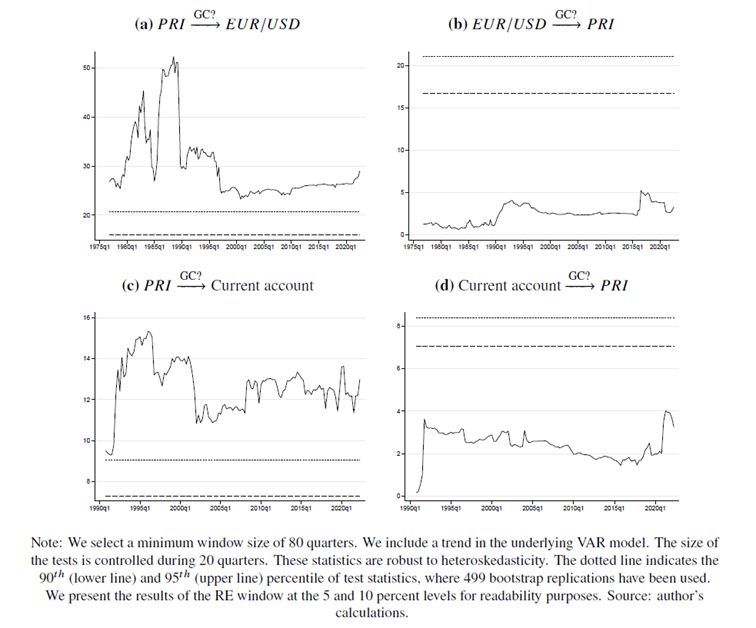

The case of Germany is particularly interesting. As shown in Figure 4, a one-way causality runs from the PRI to the exchange rate and the current account for most of the considered period. Globally, the continuously improving political relationships between China and Germany are accompanied by a depreciation of the CNY and growing current account surpluses, except at the end of the period where the tense relations that are beginning to emerge go hand in hand with the appreciation of the Chinese currency. After the entrance of China into the WTO, the relationship between China and Germany was at the heart of the global value chains. This particular link was reinforced during the enlargement in 2004 to eastern Europe, as Germany began to become the industrial core of this new EU with a center of gravity that shifted to the East. Germany and China have become two major players in terms of trade flows (Miranda-Agrippino et al., 2020).

Overall, our findings show that Montesquieu’s “doux commerce” view is not always valid for the US and UK and never for Germany. According to him, causality should run from trade to political relations since trade partnerships should produce more peaceful relationships between individuals and nations. We find that both the “doux commerce” and the “trade follows the flag” views are supported by empirical evidence over different times for the US and the UK, illustrating the relevance of a time-varying specification. The most striking result is that “trade always follows the flag” for Germany and China: we reject the null hypothesis of non-causality running from political relations to macroeconomic variables, while the null of non-causality from political relations to macroeconomic variables is not rejected. This illustrates that good political relationships were a prerequisite to the expansion of trade between China and Germany.

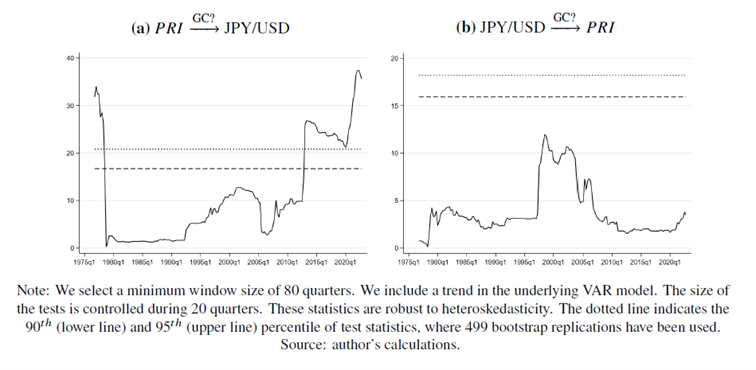

Figure 4: Time-varying causality for China and Germany

In the case of Asian partners, although there is no causality from the PRI to the exchange rate most of the time, it is significant in specific periods where particular events were at play. Sino-Japanese relations have globally followed an increasing trend until the beginning of the 2000s (Figure 5) and were significantly warmed after Shinzo Abe—and later Yasuo Fukuda – became the Prime Minister of Japan in September 2006. A strong dispute between the two countries has concerned the territoriality of the Senkaku/Diaoyu Islands, which has accentuated the tensions. This deterioration of Sino-Japanese relations has affected the yen exchange rate, as illustrated by the significant causality observed in Figure 5. Turning to Sino-Indian and Sino-Korean relations, they have improved throughout the period, explaining why causality from the PRI to exchange rates is most of the time nonsignificant. The significant causality observed during the mid-1990s for the Indian case can be explained by border issues and India’s nuclear tests, while it is notably the result of tensions linked to the severed diplomatic ties of Taipei and Seoul in 1983. Regarding the reverse causality, for the exchange rate to the PRI, it is especially significant in the 1990s for India, corresponding to a period of a sharp depreciation of the rupiah coming from current account deficits and a loss of investor confidence.

Figure 5: Time-varying causality for China and Japan

This post written by Jamel Saadaoui.