In Chinn and Ferrara (2024), we find substantial explanatory power for the 10yr-3mo, the 3 month rate, and the debt service ratio for German recessions (our analysis we also covered Canada, France, Italy, Japan, Sweden, and UK). Our sample extended up to 2022M12 (using spreads up to 2021M12), as we were unsure about recession in 2023. With Germany in a possible slowdown, it’s of interest to consider what our model would have predicted.

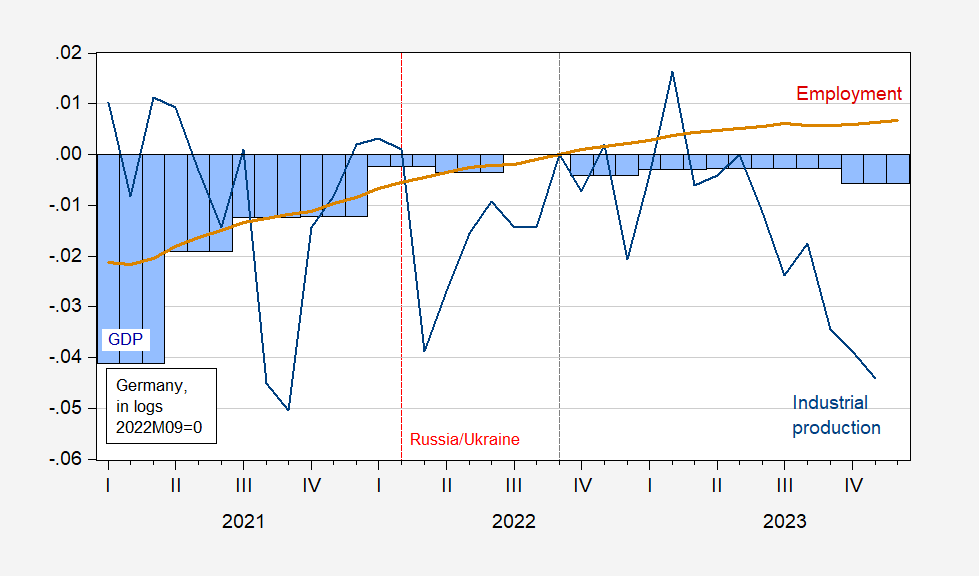

Figure 1: GDP in constant euros (blue), industrial production excluding construction (blue line), employment (red line), all in logs, 2022M09=0. Source: Eurostat, MEI via FRED, and author’s calculations.

The last peak in GDP is at 2022Q3. Peak industrial production is February 2023, while employment has continued its rise, pausing at 2023M07. I tentatively set the recession start date then. It’s important to note that neither the German Council of Economic Experts, nor ECRI have established a peak, so this is an assumption on my part. (Laurent Ferrara provides a chronology which extends up to 2019, as described here).

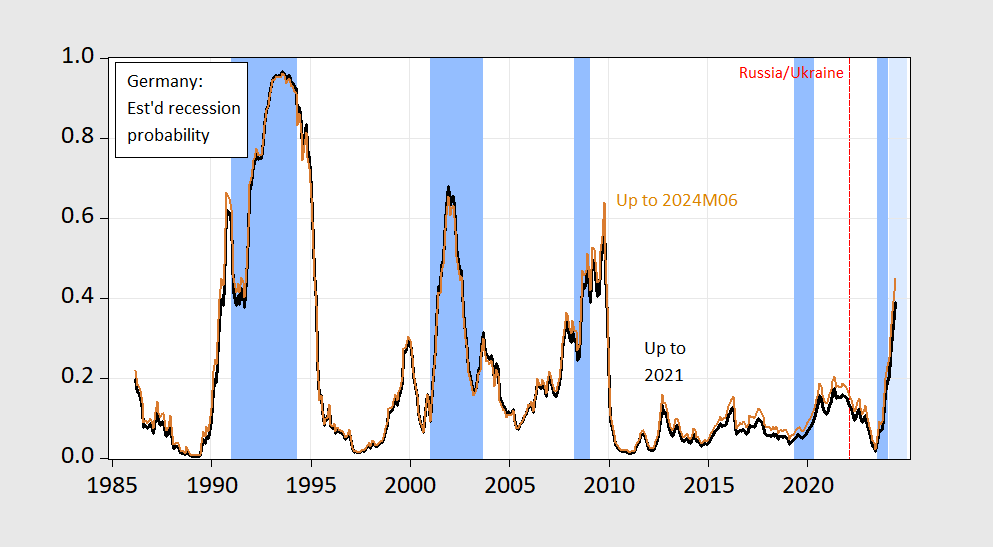

Suppose I estimate a probit regression over the period up to just before the expanded Russian invasion of Ukraine, i.e., 1985 to 2021M12 (using the spread, short rate (i3mo), and debt-service ratio (dsr) up to 2020M12) to estimate the year-ahead recession probability. The estimates are:

Pr(rec=1) = -4.85 – 60.6 spread + 5.7 i3mo + 33.9 dsr

Pseudo-R2 = 0.32, Nobs = 430, Smpl for spread, etc. 85M01-20M12. Bold face denotes significance at 10% msl.

The estimates of recession probabilities are shown in black, with ECRI defined recession dates shaded light blue, where I have assumed last peak at 2023M07.

Figure 2: Estimated probability of recession using probit models estimated up to 2021M12 (black), estimated up to 2024M01 (tan). ECRI defined peak-to-trough recession dates shaded light blue. Source: ECRI, author’s calculations.

Note that the regression misses the 2020 pandemic recession, although the probabilities do rise from a very low level. The probability of recession for 2024M01 is 19%.

Suppose I use the entire sample period up to 2024M01 (and hence the spread and other determinants up to 2023M01). Then one obtains the following estimates:

Pr(rec=1) = -4.05 – 59.7 spread + 6.54 i3mo + 27.8 dsr

Pseudo-R2 = 0.29, Nobs = 455, Smpl for spread, etc. 85M01-23M01. Bold face denotes significance at 10% msl.

The estimated probabilities for this regression are much the same, with a slightly higher probability for January 2024, at 23%.

In both cases, it doesn’t seem that the model would predict a recession at the time they are likely to have started. That being said, nobody has confirmed an ongoing recession in either Germany or the Euro area.

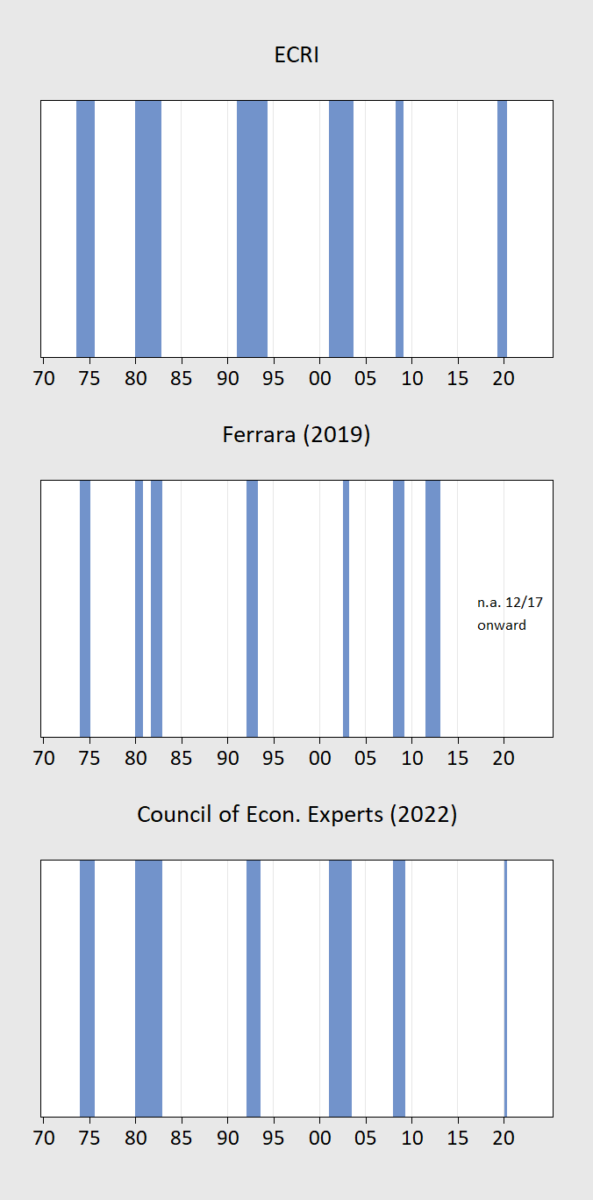

Note that there are different results if one uses different chronologies, two of which (from Ferrara (2019), and GCEE (2022)) are shown below.

Notes: All recession dates peak-to-trough shaded light blue. Sources: ECRI, Ferrara (2019), German CEE (2022).

The answers to both questions, then, are (1) maybe, and (2) maybe.