From Cui, NBC:

President Donald Trump’s tariff agenda has thrown the financial world for a loop for much of the past month. The on-again, off-again trade escalation with other nations — most notably China — has upended markets with investors fleeing U.S. stocks in search of more stable ground. And as experts and business leaders say the lack of clarity around the tariffs is every bit a challenge as the levies themselves, data shows economic uncertainty is the highest it has been in years.

As the St. Louis Fed’s Kevin Kliesen noted about the EPU:

“It’s a historically unprecedented increase,” Kliesen said.

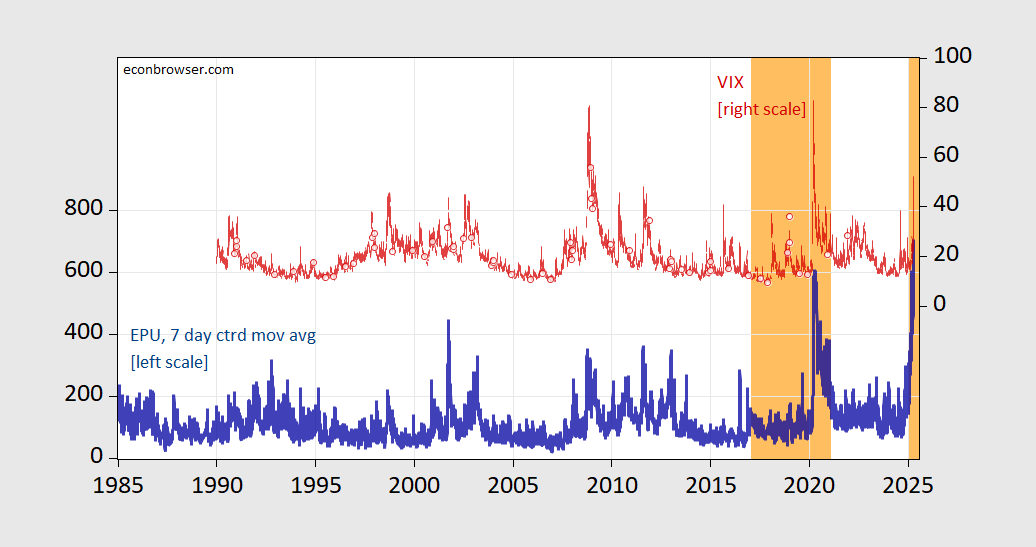

To highlight the unprecedented nature of policy uncertainty, as well as financial risk, here’s the Baker, Bloom and Davis EPU (7 day centered moving average) over 40 years, and the VIX over 35.

Figure 1: EPU, 7 day centered moving average (blue, left scale), and VIX (right scale). Orange denotes Trump Administrations. Source: policyuncertainty.com and CBOE via FRED.

This post highlights econometric estimates of the macro implications of elevated EPU and VIX.