[ad_1]

Breez, in partnership with 1A1z, has released a new report investigating the use of Bitcoin as a payments system and transactional currency. Bitcoin has always been painted as digital gold, that is one of the longest running narratives at this point in terms of what Bitcoin actually is. It does capture the use as a long-term investment or speculative asset, and has been a very helpful aid in getting people over the first hump of basic understanding, but it is by no means a comprehensive explanation of what Bitcoin is.

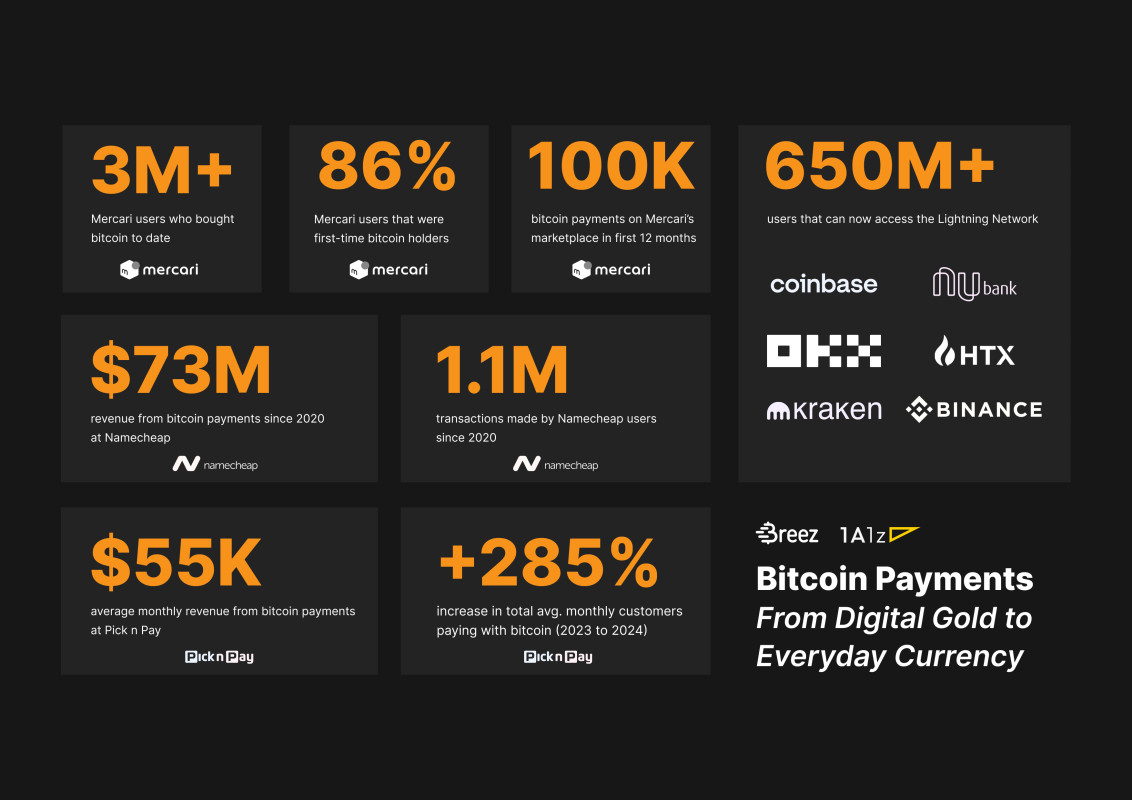

The report dives into multiple factors of Bitcoin’s use as a payment mechanism. It dissects different use cases, regulatory treatments received in different jurisdictions, services and platforms with existing integration of Lightning payments, etc.

Case studies are included looking at specific businesses and the volume of transactions or userbase they have provided access to Bitcoin for. Mercari, a major Japanese marketplace similar to Amazon, accepts bitcoin. Mullvad VPN, Namecheap, and Protonmail are all instances of digital businesses benefiting from bitcoin payments.

While the Bitcoin digital gold narrative is running strong, Bitcoin’s use as a payment mechanism is growing quietly in the background. Storing value may be a necessary component of Bitcoin’s use in commerce, but the ultimate purpose it was created for was to transact with.

Read the report here for more details on how Bitcoin’s transactional use is going through a quiet renaissance.

[ad_2]

Source link