[ad_1]

Daniel Lacalle via Zerohedge writes

Professors EJ Antony and Peter St Onge recently published an excellent study, “Recession Since 2022: US Economic Income and Output Have Fallen Overall for Four Years,” through the Brownstone Institute. It perfectly summarizes why Americans have not responded favorably to Bidenomics and his assessment of his economic legacy as the “best economy in the world” or “the best economy ever.” The study concludes that adjustments reflecting a more realistic measure of average price increases in the period have understated cumulative inflation by nearly half since 2019. An enormous divergence between reported CPI and adjusted inflation led to an overstatement of cumulative GDP growth by roughly 15%. Furthermore, these adjustments indicate that the American economy has been in recession since 2022.

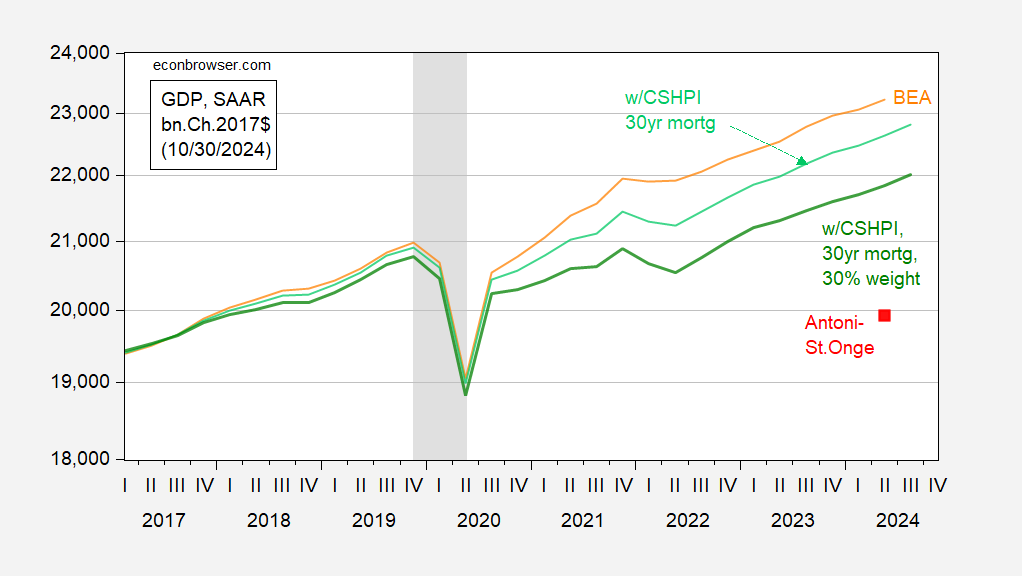

I’ve documented why the Antoni-St. Onge assessment is not to be given any credence [1] [2] [3] [4] (or as much credence as we gave ShadowStats, with which it shares a lot of DNA). I tried to replicate their price level calculations (using house prices and mortgage rates), and the closest I got was the green line below.

Figure 1: BEA GDP (orange), GDP incorporating PCE using Case-Shiller House Price Index – national times mortgage rate factor index, using BEA weight of 15% (light green), using 30% weight (dark green), Antoni-St. Onge estimate (red square), all in bn.Ch.2017$ SAAR. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, S&P Dow Jones, Fannie Mae via FRED, NBER, and author’s calculations.

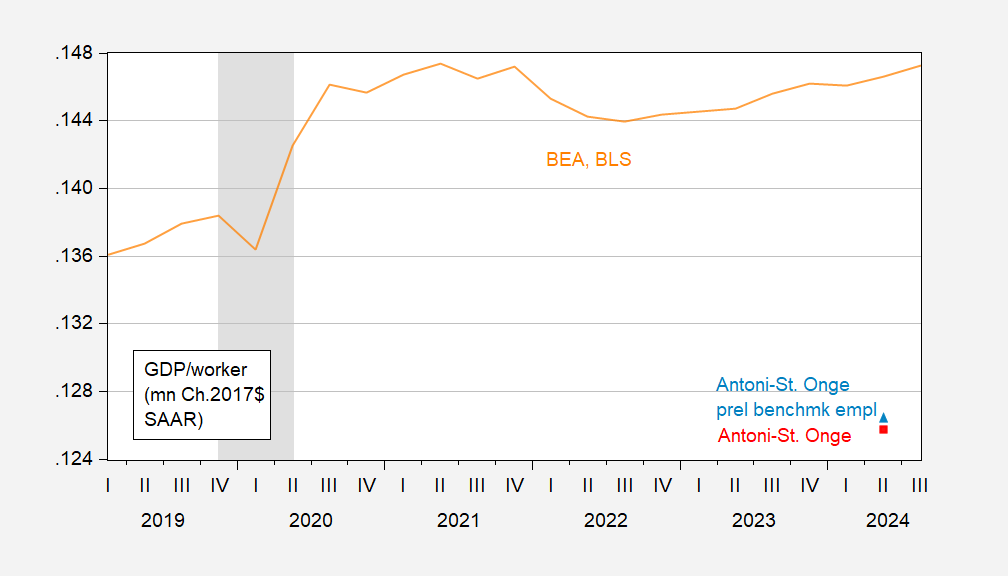

One way to think about the plausibility of their estimates is to think about what their GDP calculation implies for productivity. The red square is their number, the GDP/worker number I get from BEA and BLS series is the orange.

Figure 2: Real GDP divided by nonfarm payroll employment (orange line), and Antoni-St. Onge GDP divided by nonfarm payroll employment (red square), Antoni-St. Onge GDP divided by benchmarked nonfarm payroll employment (light blue triangle), all in mn.Ch.2017$ per worker. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, BLS, NBER, and author’s calculations.

Dr. Antoni has made much of how the preliminary benchmark has drastically reduced the number of employed (although Goldman Sachs has estimated the final revision will not be downward as much as the preliminary). Using the preliminary benchmark only pushes up the extremely low output per worker a slight amount.

[ad_2]

Source link