Business Cycle Indicators as of November’s Start

- By michigandigitalnews.com

- . November 2, 2024

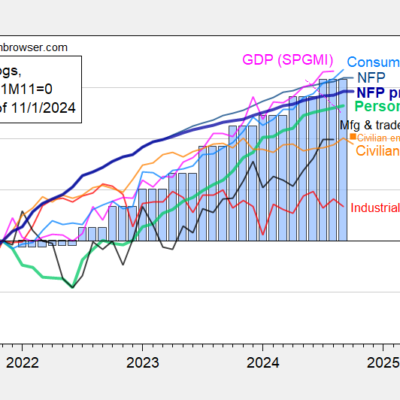

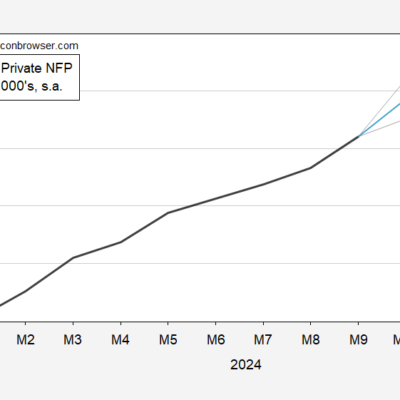

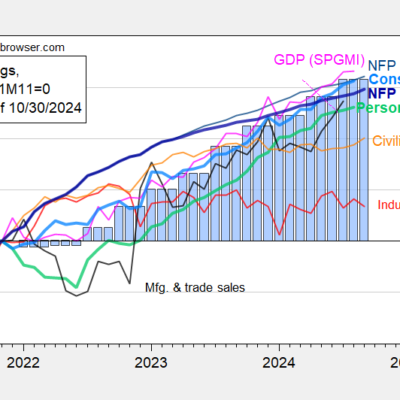

Employment for October and monthly GDP for September, in the set of variables followed by the NBER’s BCDC: Figure 1: Nonfarm Payroll (NFP) employment from CES

The Employment Release: Downside Surprise, Signifying?

- By michigandigitalnews.com

- . November 1, 2024

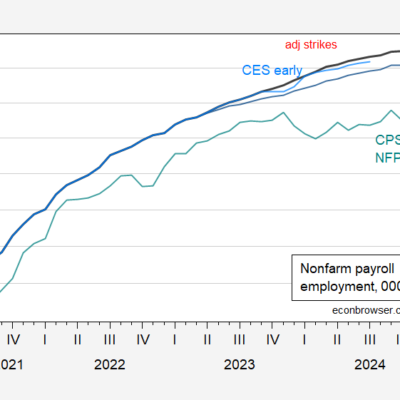

NFP +12K vs. consensus +106K, private NFP -28K vs. +90K; but wage growth (0.4% vs. 0.3% m/m) and average weekly hours both above (34.3 vs.

Prediction Markets, FWIW | Econbrowser

- By michigandigitalnews.com

- . November 1, 2024

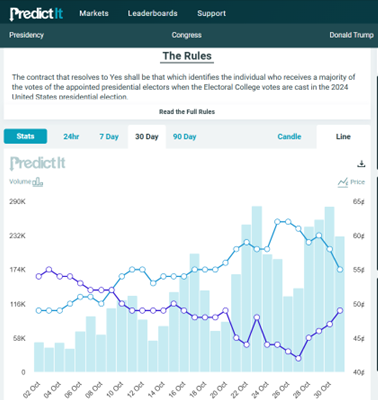

Reversion, seen over the past month. Why? Unclear given small movements in swing state polls. I would expect these odds to match, pretty closely, but

“The Economy would grow under Harris. Under Trump, expect higher prices and debt.”

- By michigandigitalnews.com

- . October 31, 2024

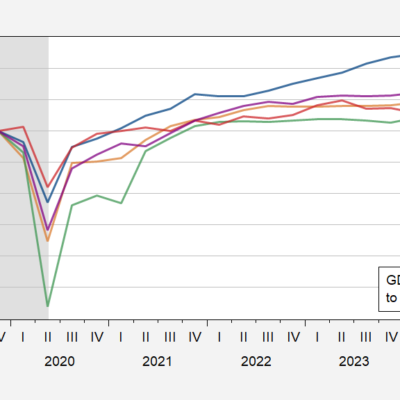

By Menzie Chinn and Mark Copelovitch A Harris administration is far less likely to disrupt the ongoing and unprecedented American economic recovery of the last

Private NFP Nowcast | Econbrowser

- By michigandigitalnews.com

- . October 31, 2024

Based on ADP-Stanford Digital Economy Lab series for October. Figure 1: Private nonfarm payroll employment (bold black), nowcast based on error correction model using ADP-Stanford

Son of ShadowStats: “Government economic figures hide the truth about the economy”

- By michigandigitalnews.com

- . October 31, 2024

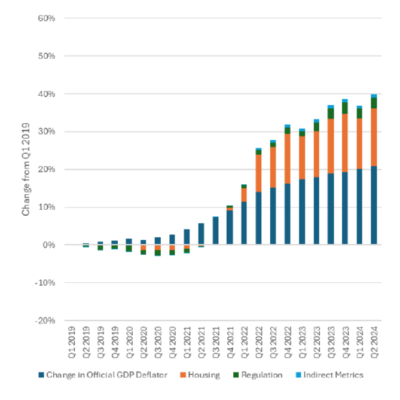

Heritage Foundation EJ Antoni channels ShadowStats: “Government economic figures hide the truth about the economy…” Thang [sic] you,@mises , for highlighting a recent paper @profstonge

Instantaneous Inflation: PCE, Market Based PCE, HICP, CPI, and Chained CPI

- By michigandigitalnews.com

- . October 31, 2024

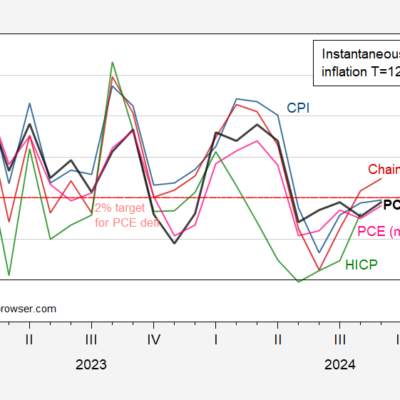

With PCE deflators released today: Figure 1: Instantaneous inflation (T=12, a=4) for CPI (blue), chained CPI (dark red), PCE deflator (bold black), PCE market based

This plane has landed safely

- By michigandigitalnews.com

- . October 30, 2024

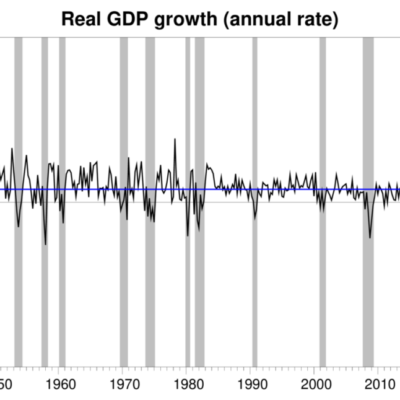

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP grew at a 2.8% annual rate in the third quarter. That’s close

Business Cycle Indicators – GDP and Private NFP

- By michigandigitalnews.com

- . October 30, 2024

GDP under Bloomberg consensus of 3.0% at 2.8% (GDPNow nails it). ADP private NFP change at 233K vs. Bloomberg consensus at 110K. Figure 1: Nonfarm

Steven Kamin & Benedictus Clements: “The Biden-Harris Macroeconomic Record Is Getting a Bum Rap”

- By michigandigitalnews.com

- . October 30, 2024

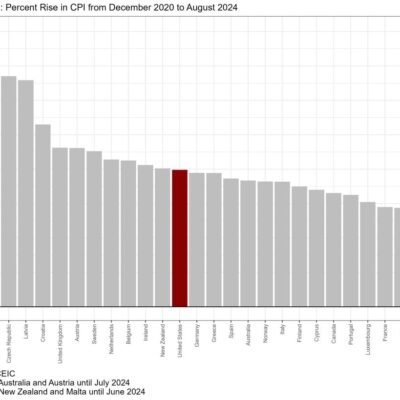

From AEI: …the US economy is indeed performing very well, and this can be seen most readily by comparing its performance with that of other