The Recession Call Revisited | Econbrowser

- By michigandigitalnews.com

- . November 9, 2024

There was a noisy minority of analysts thinking we were in, or imminently in, recession (see a list here). It’ll be interesting to see how

“The Recession of 2025 Will Be Backdated” to 2022

- By michigandigitalnews.com

- . November 8, 2024

Thet’s Jeffrey Tucker in the Epoch Times via ZeroHedge. It’s a reasonable supposition that a recession will become obvious to all by next summer. It

Debt-to-GDP under Trump 1.0 | Econbrowser

- By michigandigitalnews.com

- . November 8, 2024

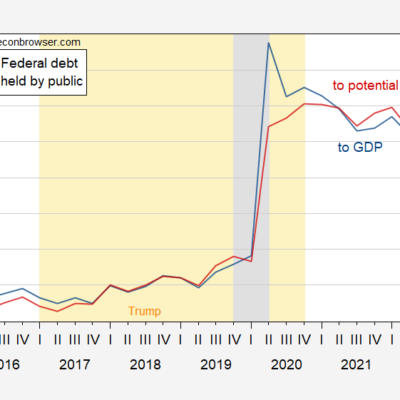

A reminder, so when next you hear about fiscal restraint. Figure 1: Debt held by the public as share of GDP (blue), and as share

Inflation Breakevens, Term Spreads Up pre-FOMC

- By michigandigitalnews.com

- . November 7, 2024

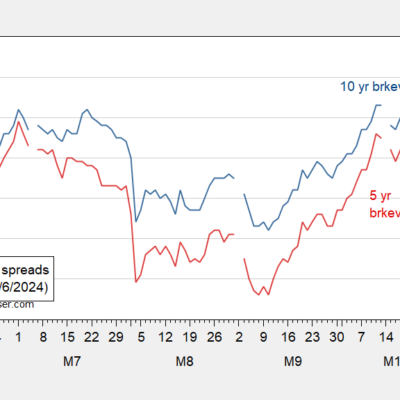

As of yesterday COB: Figure 1: Ten year breakeven (blue), five year breakeven (red), in %. Source: Treasury via FRED. Figure 2: 10yr-2yr Treasury term

Everyday Price Inflation at 0.3% y/y?

- By michigandigitalnews.com

- . November 5, 2024

Versus 2.4% for the CPI (in logs). Lots of people think the government’s statistics understates the true inflation rate. It used to be John Williamson

Some Last Pictures: Trade War 2.0

- By michigandigitalnews.com

- . November 5, 2024

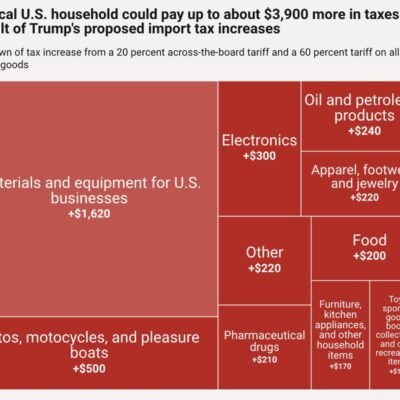

Impact on a typical family: Source: Brendan Duke, CAP. From McKibben, Hogan, Noland (2024), cost to US economy from 10% tariffs, in GDP and inflation

Farmers of the Nation, Unite! You Have Nothing to Lose but Possible Retaliation against Soybeans and Corn

- By michigandigitalnews.com

- . November 4, 2024

From the National Corn Growers Association: U.S. soybeans and corn are prime targets for tariffs. As the top two export commodities for our country, together

Recession after the Election? | Econbrowser

- By michigandigitalnews.com

- . November 3, 2024

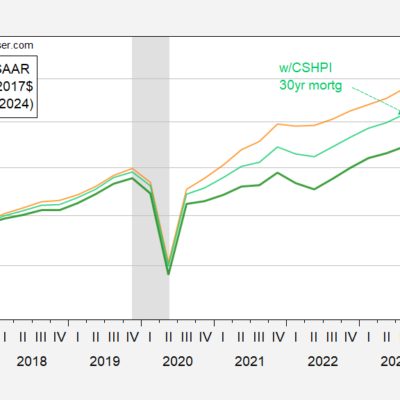

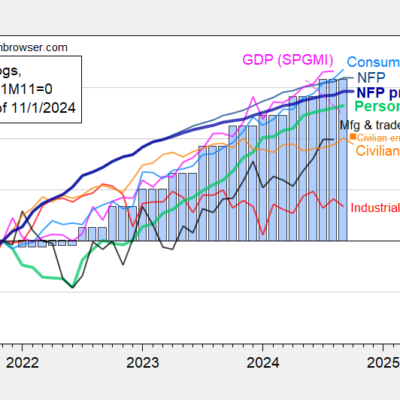

Charles Payne joins the recession camp. Current indicators are not very supportive of an imminent recession: Figure 1: Nonfarm Payroll (NFP) employment from CES (blue), implied

Prediction Markets Moving on “News” (on One Poll)

- By michigandigitalnews.com

- . November 3, 2024

Apparently, one poll in Iowa has moved PredictIt. Harris v Trump, 52-53 now flipped to 57-50. Both markets accessed 7:05pm CT on 11/2/2024. I think

UMich Sentiment Catching Up with the (Good Economic) News?

- By michigandigitalnews.com

- . November 3, 2024

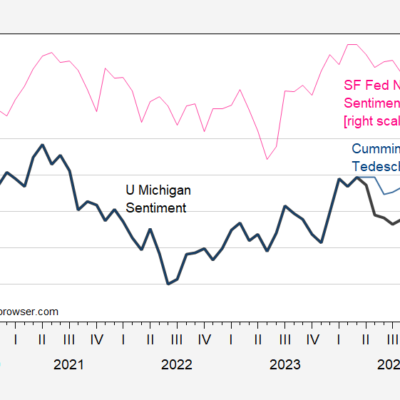

From TradingEconomics on 10/25: The University of Michigan consumer sentiment for the US was revised higher to 70.5 in October 2024 from a preliminary of