Federal Interest Payments: To the Public vs. To the Rest-of-Federal Government

- By michigandigitalnews.com

- . October 20, 2024

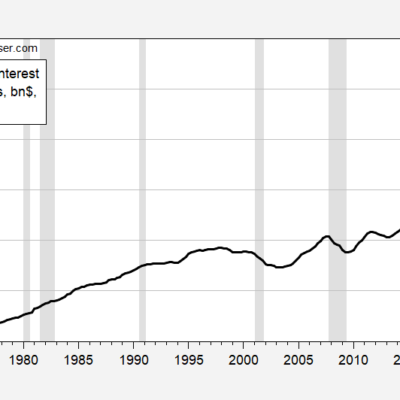

Ode to an EJ Antoni graph (apologies to Keats). Total interest payments have risen substantially, and this shows up in a scary picture: Figure 1:

Dollar Demise Predicted | Econbrowser

- By michigandigitalnews.com

- . October 19, 2024

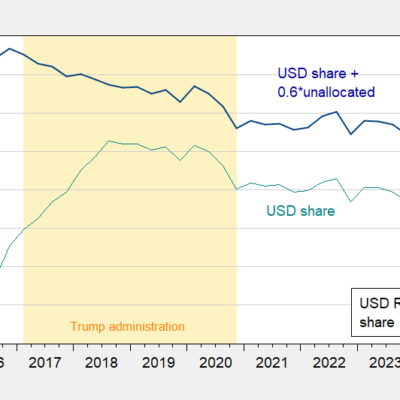

Joe Biden is dethroning King Dollar in real time. The US dollar’s financial dominance is under siege from a uniquely bad combination of foreign and

It’s Almost as If Some People Were Rooting for Recession (Part 2)

- By michigandigitalnews.com

- . October 18, 2024

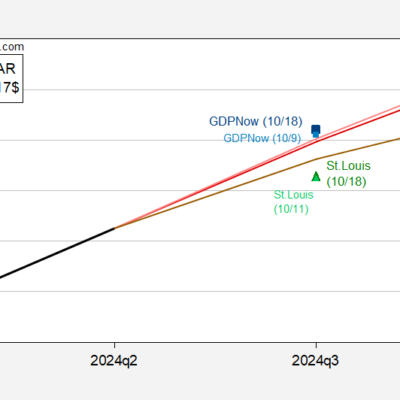

“Latest Q3 Nowcasts: ATL 2.5% (2.0% prev) NY 2.49% (1.94 prev) STL 2.05% (1.65 prev) It’s going to take stellar consumer spending numbers for Aug

Wisconsin Economic Sit-Rep | Econbrowser

- By michigandigitalnews.com

- . October 18, 2024

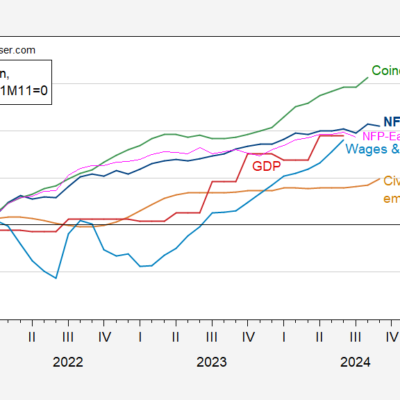

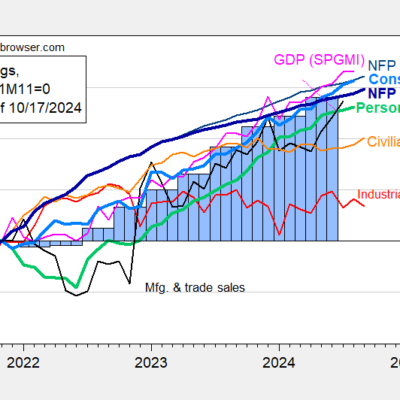

DWD released employment numbers for September today. Figure 1: Wisconsin Nonfarm Payroll Employment (dark blue), Philadelphia Fed early benchmark for NFP (pink), Civilian Employment (tan), real

Eric Hovde: In Recession | Econbrowser

- By michigandigitalnews.com

- . October 18, 2024

Video today. 55% of Americans believe they are in a recession. Why? Because they have been in one. Most indicators suggest otherwise. Here are some

Has American Economic Output Been in Decline since 2022?

- By michigandigitalnews.com

- . October 18, 2024

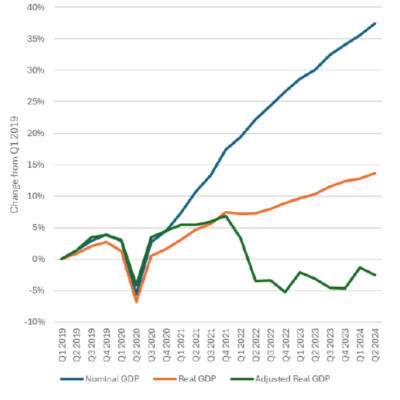

This is the premise of a new paper by Peter St. Onge and EJ Antoni. I have been trying to find a deflator that can

Big Mac Nation and Recession since 2022

- By michigandigitalnews.com

- . October 17, 2024

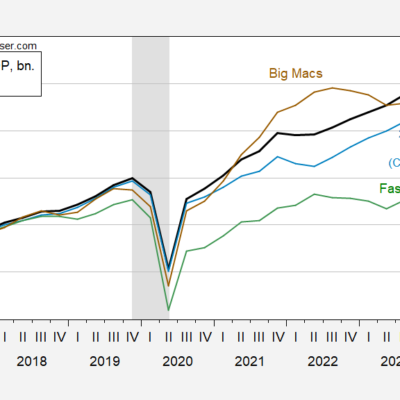

In a recent paper, Antoni and St. Onge (2024) have argued that the peak in GDP, properly measured, was in 2021Q4. Source: Antoni and St. Onge (2024).

Mid-October Reading on Business Cycle Indicators – NBER BCDC and Alternatives

- By michigandigitalnews.com

- . October 17, 2024

Industrial and manufacturing production below consensus (-0.3% m/m vs -0.1%, -0.4% vs -0.1%, respectively), while retail sales and core retail sales above consensus (+0.4% m/m

Fed Inflation Credibility Measured | Econbrowser

- By michigandigitalnews.com

- . October 17, 2024

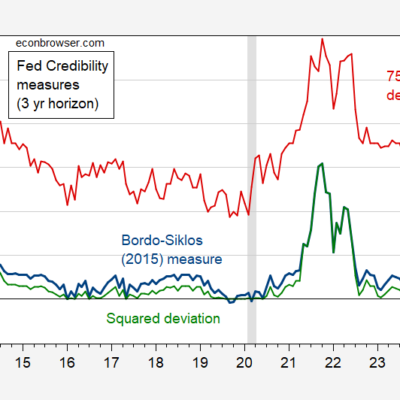

Has the Fed lost credibility, as some people have argued (e.g., EJ Antoni)? One way to assess credibility is to see whether people’s expectations of

WSJ October Survey: GDP On the Rise

- By michigandigitalnews.com

- . October 17, 2024

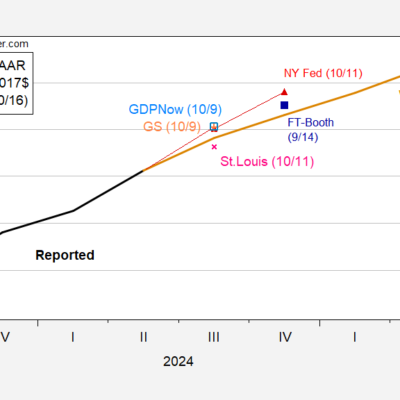

Only one forecaster projects two consecutive quarters of negative growth. Here’s the WSJ mean forecast compared to nowcasts: Figure 1: GDP (bold black), WSJ October