[ad_1]

That would explain a lot. He’s not very effective at much, but he is effective at setting the preconditions for a recession. From Yahoo!Finance quoting the Kobeissi Letter:

“In a way, President Trump may actually want a recession,” the post says. “A recession achieves most of Trump’s economic goals at once,” referring to his campaign promises of low inflation, treasury yields, a reduction in trade deficits, a rate cut by the Federal Reserve, and lower oil prices.

As I’ve discussed before, it’s hard for tariffs (a microeconomic tool, with sometimes macro consequences) to substantially reduce the trade deficit especially when foreign countries can retaliate.

I wondered, then, what it would take to get the trade deficit to zero, by way of exchange rate depreciation or recession (or, expenditure switching vs. expenditure reduction). Consider the following graph.

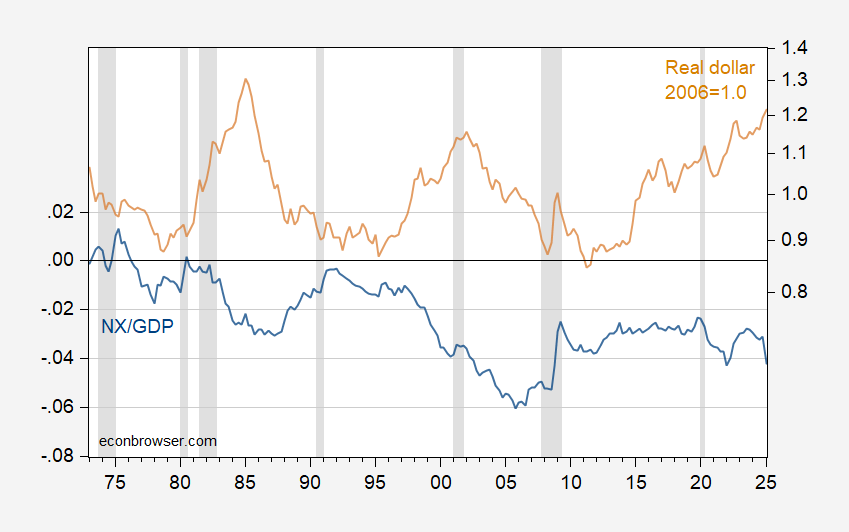

Figure 1: Net exports to GDP (blue, left scale), and real value of US dollar, 2006M01=1 (tan, right log scale). NBER defined peak-to-trough recession dates shaded gray. Source: BEA 2025Q1 second release, Federal Reserve, and NBER.

Note that some observers have indicated 20-30% as a reasonable number. One of those is Peter Hooper who at the Fed coauthored a well known paper on trade elasticities; however, I think the 20-30% figure is a number which incorporates other effects besides just the relative price effects).

In order to answer the question of required depreciation, we need elasticity estimates. Without going into extensive calculations, I obtained some back of the envelope estimates (for more detailed analyses, but on older data, see here).

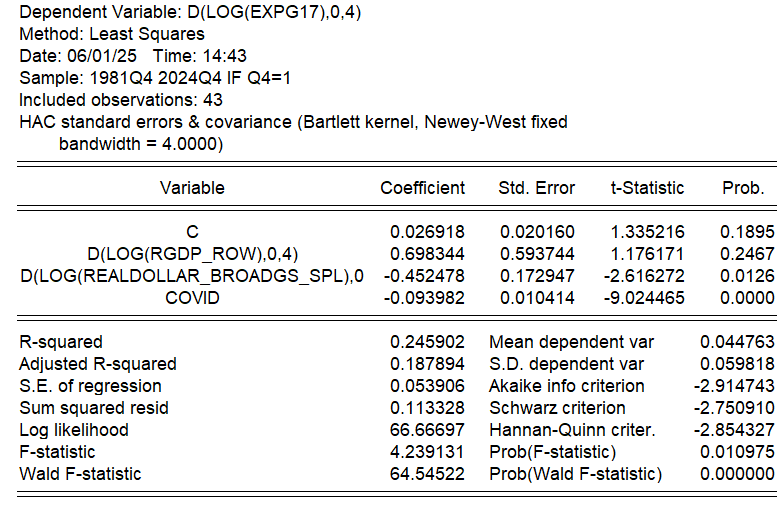

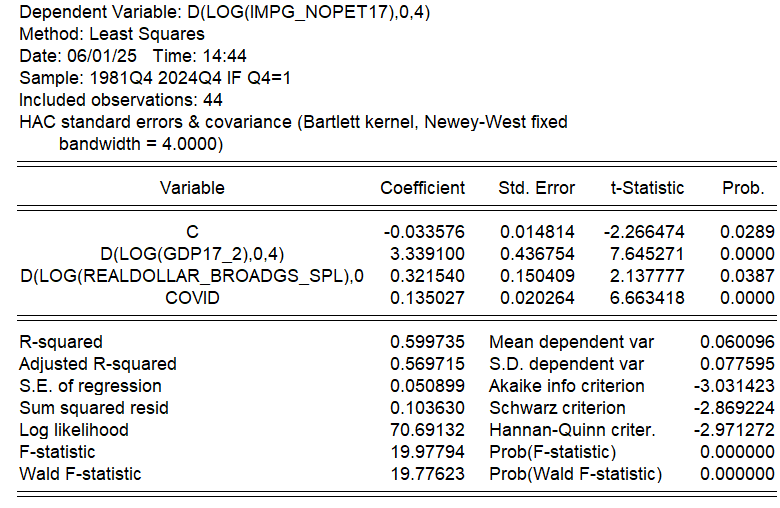

These are regressions of y/y growth rates, non-overlapping (sampled at Q4) for goods exports on rest-of-world US export weighted GDP and real value of dollar, and for non-oil goods imports on US GDP and real value of the dollar, along with a Covid dummy (imports, exports, GDP in real terms).

Confirming my earlier estimates, export price elasticities are higher than non-oil import price elasticities, and import income elasticity is very high.

Using these estimates, I conduct back of the envelope calculations to see what changes are needed for an elimination of the 1053 bn Ch.2017$ reduction the net export deficit (2024Q4 numbers).

By my calculations, a 20% real depreciation of the dollar only gets one about a third of the way (326 bn), while a 1.4% reduction in GDP relative to trend will zero out the trade deficit, assuming the rest-of-the-world does not experience any decline (so that US exports are stable). While 1.4% doesn’t sound like a large number, given a baseline growth rate of 1.8%, this implies about a 3.2% decline relative to baseline.

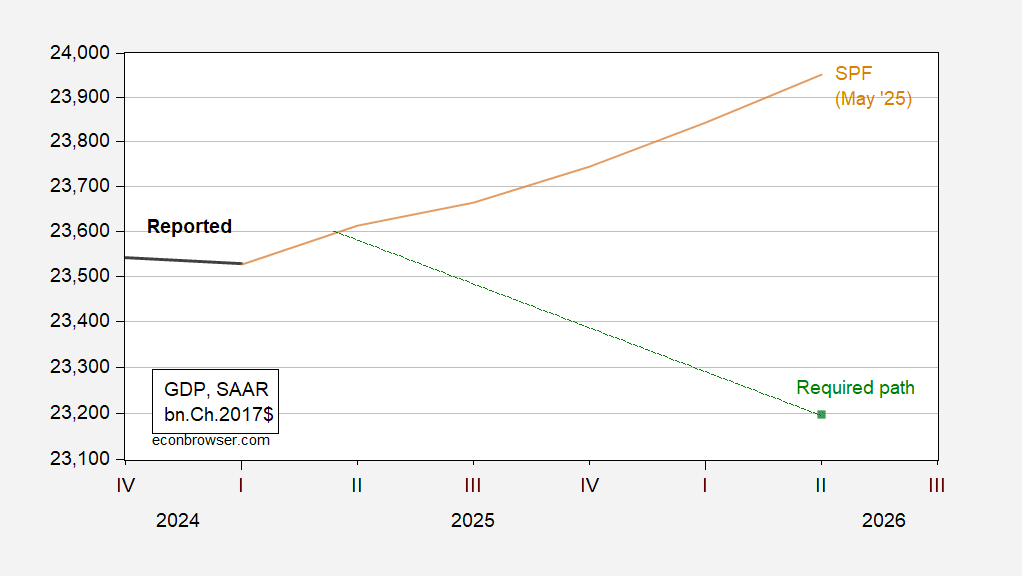

Using the SPF forecast, this implies GDP would have to be 23197 vs 23952 in 2026Q2.

Figure 2: GDP (bold black), SPF May forecast (tan), and level of GDP necessary to balance real net exports (green square), all in bn.Ch.2017$ SAAR. Source: BEA 2025Q1 second release, Philadelphia Fed, and author’s calculations.

By the way, how can one get a dollar depreciation? Lowering interest rates (which would spur aggregate demand, tending to increase imports), destroying confidence in the dollar as a safe haven (been there, done that…but I guess the Trump administration could do more), or force foreign countries to appreciate their currency (e.g., China, Korea, Taiwan). Not sure that’s feasible, but I’m sure the Trump team will do their darndest.

[ad_2]

Source link