[ad_1]

“…an increasing number of indicators say the recession has arrived in the broader economy.”

Here are key indicators followed by the NBER Business Cycle Dating Committee, as of last relevant release (for those available as of 8/28, see my original post).

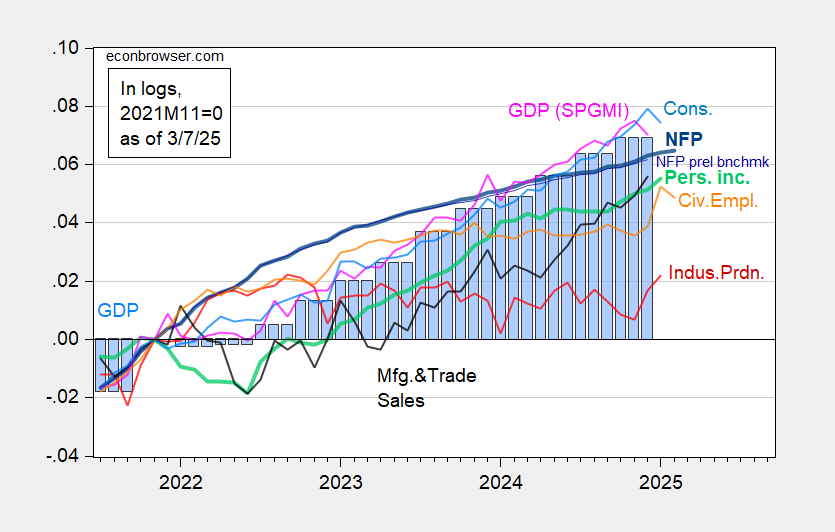

Figure 1: Nonfarm Payroll (NFP) employment from CES (bold blue), NFP implied preliminary benchmark revision (blue), civilian employment as officially reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/3/2025 release), and author’s calculations.

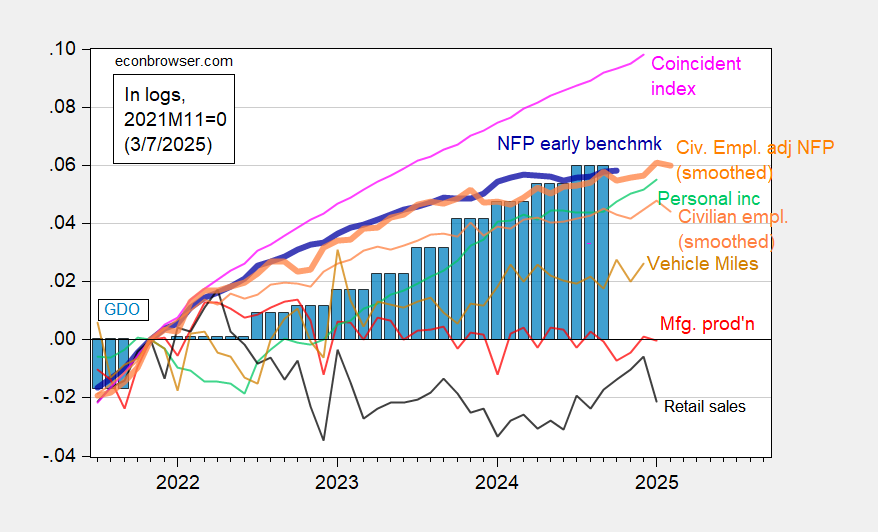

Of these indicators, I’d only count civilian employment from the household survey and perhaps industrial production as signaling a possible recession. Of course, industrial production (as measured by value added) is only about 15% of GDP. And the CPS based civilian employment has serious problems. Showing the BLS’s research series using smoothed population controls yields a more favorable view of labor market conditions. Alternative indicators are shown along with the pop control smoothed civilian employment and civilian employment adjusted to NFP concept, drawn on the same vertical scale as for Figure 1, for the sake of comparability.

Figure 2: Nonfarm Payroll early benchmark (NFP) (bold blue), manufacturing production (red), retail ales in 2019M12$ (black), vehicle miles traveled (tan), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: BLS [1], [2], Philadelphia Fed, Federal Reserve, Census, via FRED, BEA 2024Q4 advance release and author’s calculations.

The usual caveat applies — all these series will be revised, particularly the GDP series, which is why the NBER BCDC does not place primary reliance upon this series (see how the 2001 recession only briefly fit the two consecutive quarter rule-of-thumb, here).

The one indicator in favor of the recession call is the real-time Sahm rule. The caveat here is that the indicator is pulled up because of a major labor force increase, rather than employment decrease, as shown in this post. I have recalculated the Sahm rule using unemployment and labor force series incorporating smoothed population controls, provided by the BLS; in this case the Sahm rule is just at the threshold of 0.5 ppts at August 2024.

[ad_2]

Source link