[ad_1]

No tariffs yet on Canada, Mexico (and EU for that matter). Still, 10% on $427 bn imports (on top of previous tariffs) is a big deal.

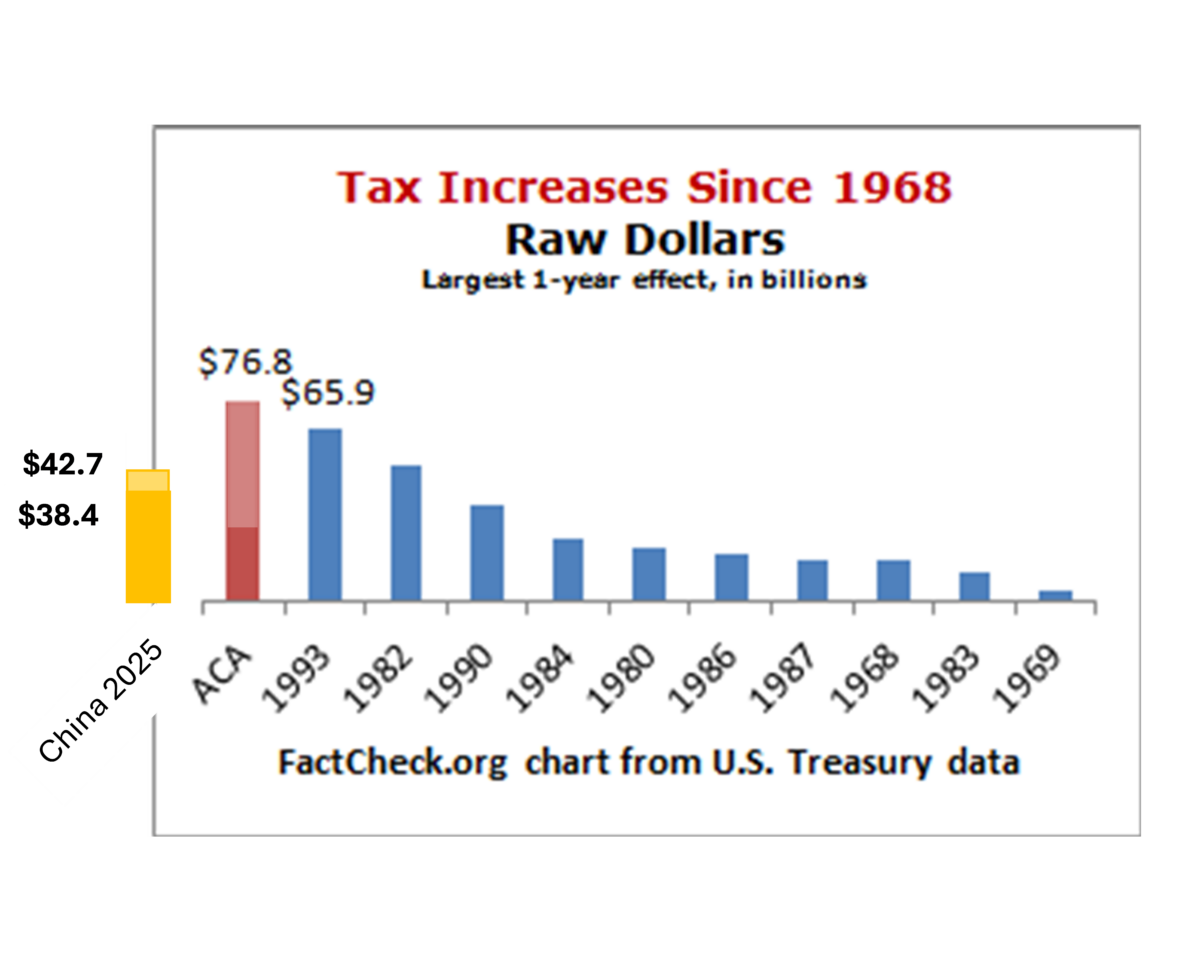

Notes: Tax increase associated with announced Trump tariffs on China assuming a unitary price elasticity of import demand (tan bar), and assuming zero (tan bar plus orange bar). ACA revenue estimate as of 2012. With numerous legislative changes, CBO estimate for 2016 is $24 bn (dark red bar). Source: graphic from Factcheck (2012), modified by author, CBO (Table 1).

In 2023, the US imported $427 bn worth of goods (goods imports are most of what we import from China). Assuming unit elasticity on a 10% tariff, we’d import $384 bn. The respective tariff revenue is $42.7 bn or $38.4 bn — this is the amount of tax revenue irrespective of what happens to the exchange rate or the gate price in China (if you don’t understand this point, it’s the difference between tax incidence and formal revenues).

Whether the China tariffs of 2025 constitute the third or fourth largest tax increase depends on how the ACA revenue estimates played out, after various legislative changes.

Combined two year 2018-2019 Section 232 and Section 301 tariffs amounted to $80 billion [Tax Foundation], so the taxes on imported goods coming from China still amount to the biggest one year tariff revenue increase.

How well does my estimate of $38 bn fit with other estimates. The Tax Foundation just released estimates of $20 bn revenue raised for the remaining 7 months of FY 2025, or $34 bn/year, so pretty close.

Trump has stated that the EU is now in the crosshairs [NYT].

Tariffs “will definitely happen with the European Union,” Mr. Trump told the BBC Sunday evening, and they are coming “pretty soon.”

Here is 2023 import value from the EU:

Source: ITA.

Not only is the amount larger than for either Canada or Mexico (for just goods), it’s of a different character, much more characterized by intra-industry trade. You can guess the demand elasticity is probably lower.

[ad_2]

Source link