[ad_1]

Joe Biden is dethroning King Dollar in real time. The US dollar’s financial dominance is under siege from a uniquely bad combination of foreign and domestic policies, and Americans should be deeply concerned by the fallout if the dollar loses its 80-year reign as the world’s reserve currency.

That’s from an article by EJ Antoni and Peter St. Onge, back in March 2023. The use of financial sanctions is the trigger for foreigners to flee US dollar assets. The result?

If foreigners no longer want them for trade, central bank reserves, private wealth funds, and the official currency of about a dozen countries, all those dollars have nowhere to go but back to us in a flood like our country has never seen. This flood will compete for goods and services in the US against the dollars already here as decades of accumulated trade deficits come flooding back all at once.

At that point, hyperinflation will not be hyperbole

OK. Time for some data.

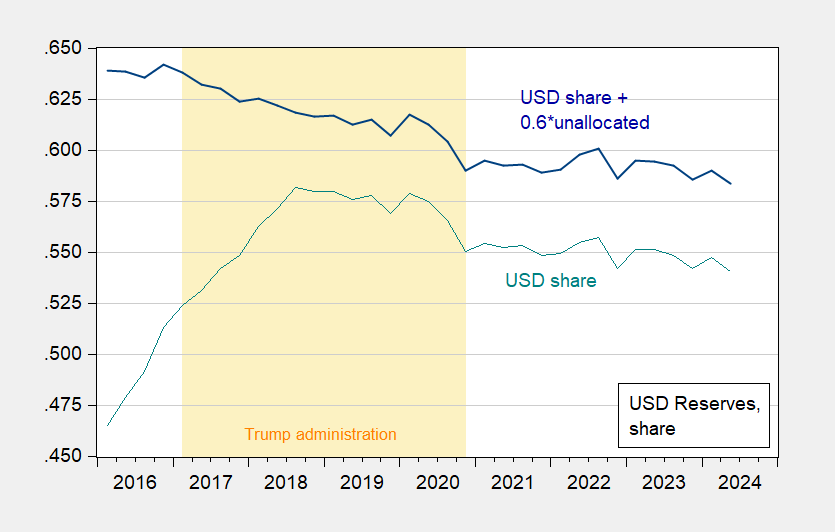

Figure 1: USD share of total reserves as reported (light blue), and USD share plus 60% of unallocated share (bold blue). Source: IMF, COFER, and author’s calculations.

While this reduction in dollar share might seems precipitous, it’s interesting to note the faster shift was during the Trump administration. In any case, some context is useful.

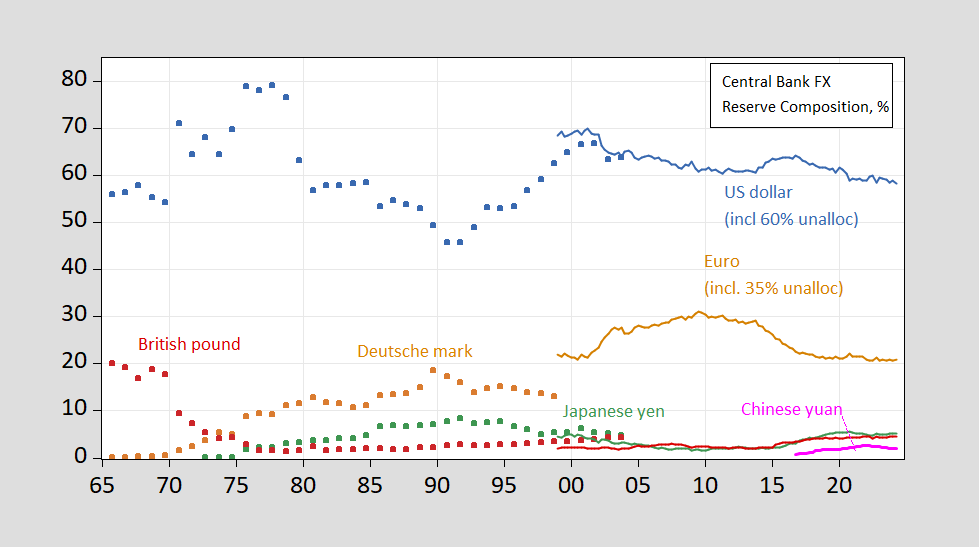

Figure 2: Share of foreign exchange reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (green), GBP (sky blue), Swiss francs (purple), CNY (red). For 1999 data onward, estimates based on COFER data, and apportionment of unallocated reserves, described in text. Source: Chinn and Frankel (2007), IMF COFER accessed 10/1/2024, and author’s estimates.

The decrease from 2022Q3 can be accounted for by the decrease in the value of the US dollar (remember the shares are calculated using currency values evaluated using market exchange rates). So, a bit premature to worry about the end of the dollar’s reserve currency hegemony.

Do we know if sanctions spurred a decline in dollar holdings? Not really. From Chinn, Frankel and Ito (2024), we know through 2021, they didn’t. Of course, Antoni and St. Onge are referring to the 2022 sanctions in response to Russia’s expanded invasion of Ukraine. In ongoing work, we’ll asses whether there was an impact in 2022 (once we have the data).

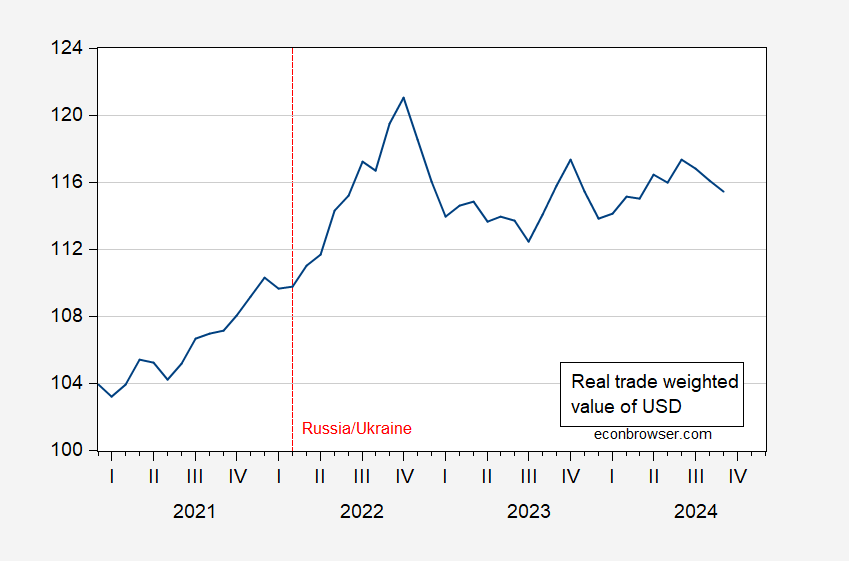

Oh, and the dollar’s appreciated (in real terms) since the sanctions were imposed.

Figure 3: Real trade-weighted value of the US dollar (blue). Up is appreciation. Source: Federal Reserve via FRED.

[ad_2]

Source link