[ad_1]

Some recent items: papers by Chinn, Frankel and Ito and Kamin and Sobel; talk by Mark Copelovitch on Tuesday.

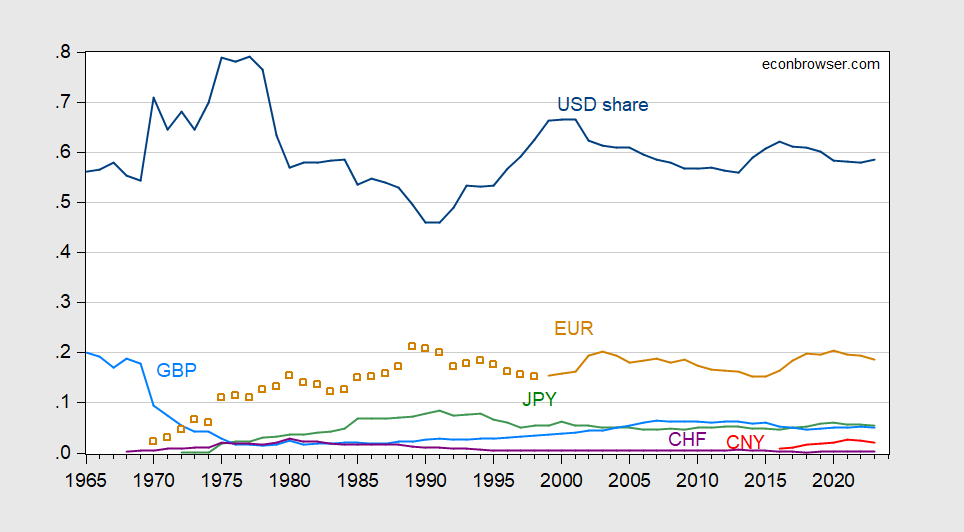

By Chinn, Frankel, and Ito (2024), updating Chinn and Frankel (2007, 2008), on the central bank reserve aspect:

Figure 1: Central bank holdings of foreign exchange, by currency. 2023 value is for Q3. Source: Chinn, Frankel, Ito (February 2024).

Below is a list of some of the sanctions imposed by the US and other G7 countries on Russia since it invaded Ukraine:

- Financial sanctions

- Freezing $300 billion in Russian international reserves

- Prohibiting US/Russia transactions in IMF SDRs

- Removal of prominent Russian banks from SWIFT

- Freezing US assets of some Russian banks

- Prohibiting US institutions from process Russian debt payments

- Trade restrictions and export controls

- Oil price cap

Not all of these sanctions depend on the dominance of the dollar in the international financial system, but many of them do. In particular, actions that cut Russia off from dollar transactions or freeze its dollar assets can exert material harm on its economy, and are a helpful complement to other US and Western diplomatic and strategic instruments.

Some critics have complained that such a “weaponization” of the dollar by the United States risks diminishing the dollar’s dominance by pushing countries to use other currencies in order to evade the sanctions. Financial sanctions have increasingly been used by Administrations, particularly in the wake of 9/11. Policymakers view financial sanctions as a strong and useful ‘stick’, short of warfare, that complements the ‘carrot’ of diplomacy. Recourse to excessive or abusive use of financial sanctions could accelerate foreign propensity to use alternatives to dollars – for example, Europe’s effort to build an alternative payments mechanism in the wake of US abandonment of the Joint Comprehensive Plan of Action against Iran.

But again, America’s extensive alliance structures significantly mitigate such a development. Moreover, when financial sanctions are imposed multilaterally in coordination with our allies rather than pursued unilaterally, and applied with restraint and only in response to egregious actions and in furtherance of strategic objectives, any adverse impact on the dollar’s financing and reserve role should be substantially minimized. In contrast, we would argue that excessive US use, if not abuse, of financial sanctions will weaken the effectiveness and ability to use this tool in the future.

In short, concerns about the use of financial sanctions significantly hurting the dollar’s stature are overstated. First, as noted above, only a small fraction of countries are likely to be motivated by sanctions to seek alternatives to the dollar. Most advanced economies have close ties with the United States, either through political/military arrangements such as NATO, through largely economic arrangements such as the G7 or the OECD, or through shared values such as respect for democratic norms. Many emerging markets and developing countries also have close political ties with the United States, even if some of them choose to also maintain relations with countries that have tense relations with the “West”. Finally, for all of these countries, the enormity of the US economy as a market for goods, services, and investment cannot be underestimated. Very few countries would be prepared to run the risk of losing significant access to the US market. These considerations both buttress the effectiveness of US sanctions and ensure that use of these sanctions will not jeopardize the dominance of the dollar.

Mark Sobel on video at UW Madison, back in April.

My colleague Mark Copelovitch (on leave, at American Academy in Berlin) has a talk on the dollar’s role on Tuesday.

The Atlantic Council has a “Dollar Dominance Monitor” if you want to see up-to-date figures. Other views: CFR in July, Eswar Prasad in 2022. Jeffrey Frankel on “Dollar Rivals” (2023) . JP Morgan on dedollarization (August). My January look at BRICS dollar vs. RMB holdings. Friendshoring in reserves, from OMFIF (August).

The ECB’s the international role of the euro (June).

PIIE’s “Floating at 50” conference, April 2023.

Senator Theoden, on the use of economic sanctions as a threat to dollar’s role as an international currency. (Senator Theoden on Navalny’s death: null set (as of 3pm CT today)).

[ad_2]

Source link