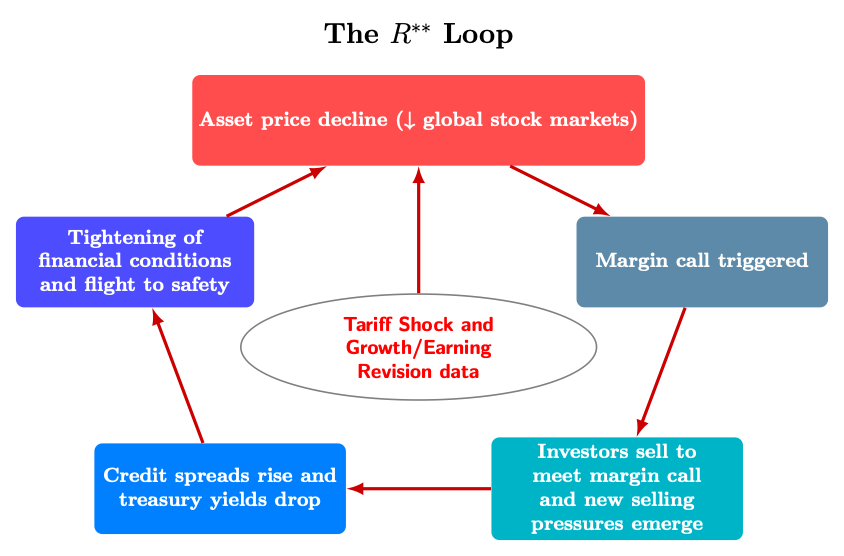

Gianluca Benigno points out that large and pervasive tariffs will have macro implications that spur deleveraging and a decline in R** in a pernicious (my word) feedback loop.

Source: G. Benigno (2025).

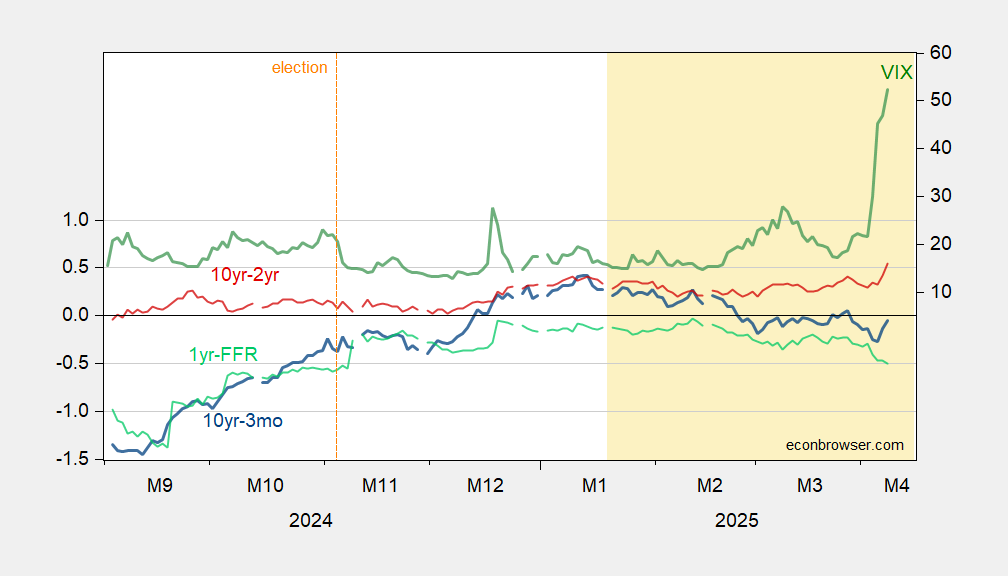

The 10 year yield is surging, so some spreads are steepening.

Figure 1: 10yr-3mo Treasury term spread (blue, left scale), 10yr-2yr Treasury term spread (red, left scale), 1yr-Fed funds (light green), all in %, VIX at close (green, right scale). Source: Treasury, CBOE via FRED.

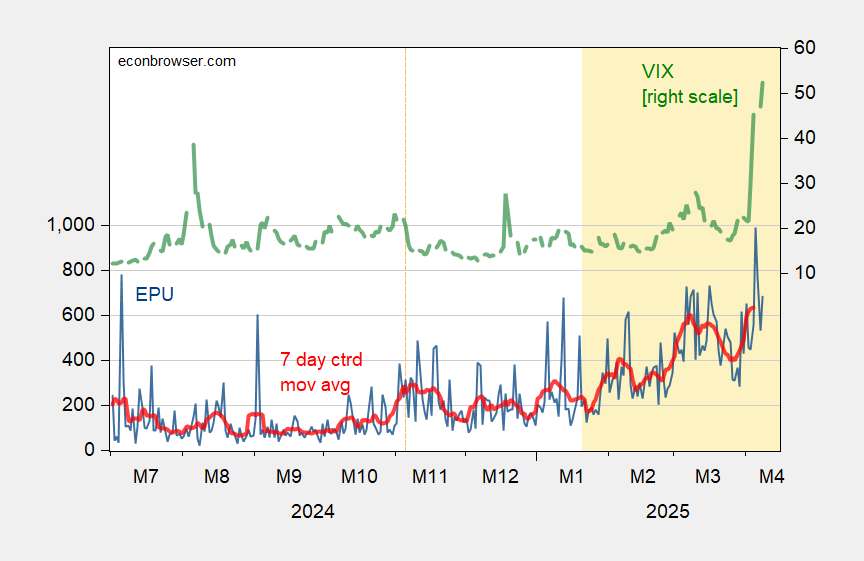

And the VIX is rising, as measured policy uncertainty is rising.

Figure 2: EPU (blue, left scale), and centered 7 day moving average (red, left scale), VIX (green, right scale). Source: policyuncertainty.com, CBOE via FRED, and author’s calculations.

Interpreting uncertainty shocks as negative demand shocks means that the model I used for analyzing the trade war is missing a piece. The IS curve shifts inward, on net, adding in depressed investment and consumption on top of retaliation effects.

With the dollar losing safe haven status, even if limited, the dollar will depreciate rather than appreciate (as I had expected).

This should place additional upward pressure on import prices (both inclusive and exclusive of tariffs).

In short, we are moving toward a financial disruption on top of a macro hit. Where it will all end up is a big question mark, bigger than I thought just a week ago.

Kalshi records recession odds at 66% right now, up 23 percentage points from just a week ago.