U.Michigan consumer sentiment and Conference Board economic confidence rise. But expectations drop.

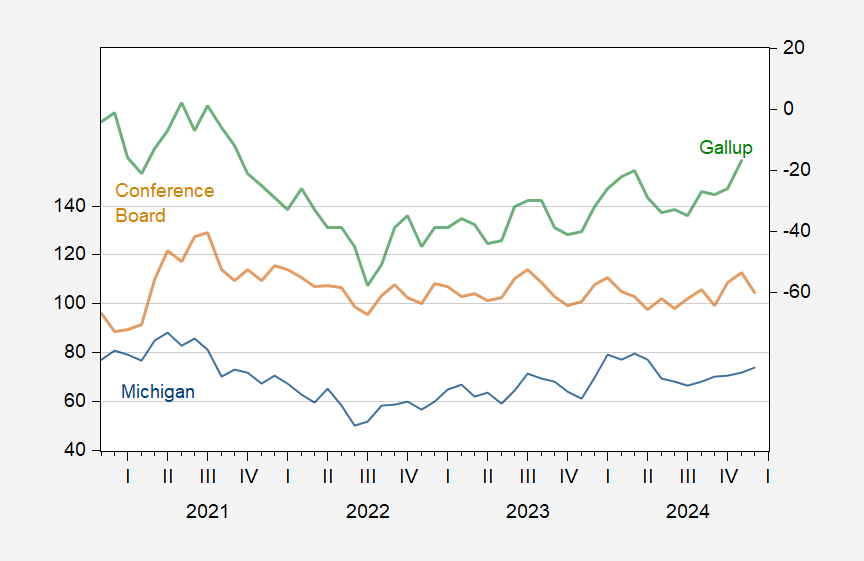

Figure 1: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Economic Confidence (tan, left scale), and Gallup Economic Confidence (green, right scale). Source: U.Michigan via FRED, Conference Board, Gallup.

Current conditions were up partly because of the impetus to buy now to avoid future tariffs.

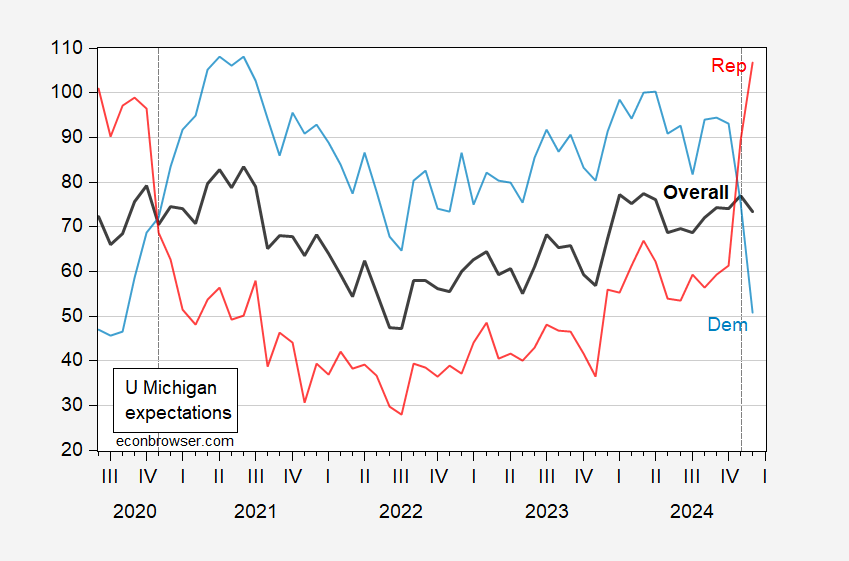

Interestingly, expectations as measured by U. Michigan have dropped, attributed to anxiety regarding the effects of tariffs. Still, Republicans/lean Republican have seen their expectations soar, while Democrats/lean Democrats have seen the reverse (as happened, in reverse, in 2020).

Figure 2: University of Michigan Expectations (bold black), expectations of Democrats/lean Democratic (blue), expectations of Republicans/lean Republican (red). Source: University of Michigan, FRED.

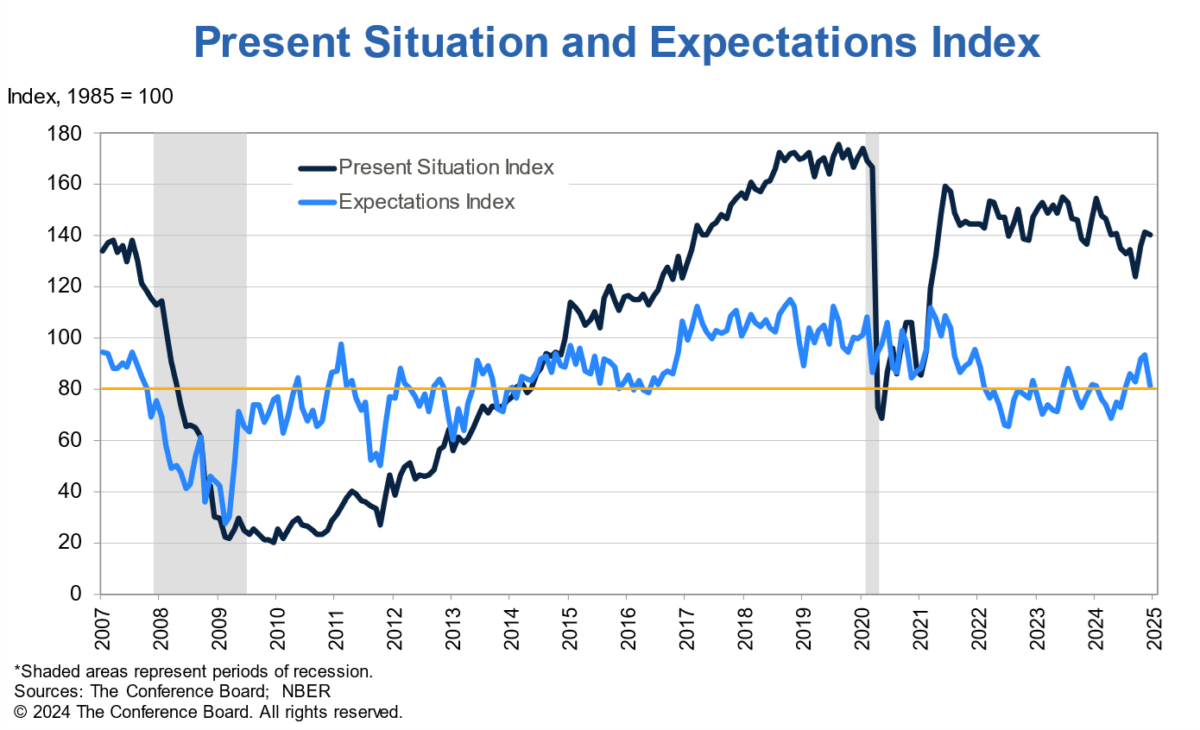

The Conference Board expectations index also evidenced a drop:

Source: Conference Board.

The Conference Board’s note on the December results included:

In write-in responses about factors affecting consumers’ views of the economy, mentions of politics—including the outcome of November’s elections—continued to rise. Mentions of tariffs also increased in December. Notably, a special question this month showed that 46% of US consumers expected tariffs to raise the cost of living while 21% expected tariffs to create more US jobs.

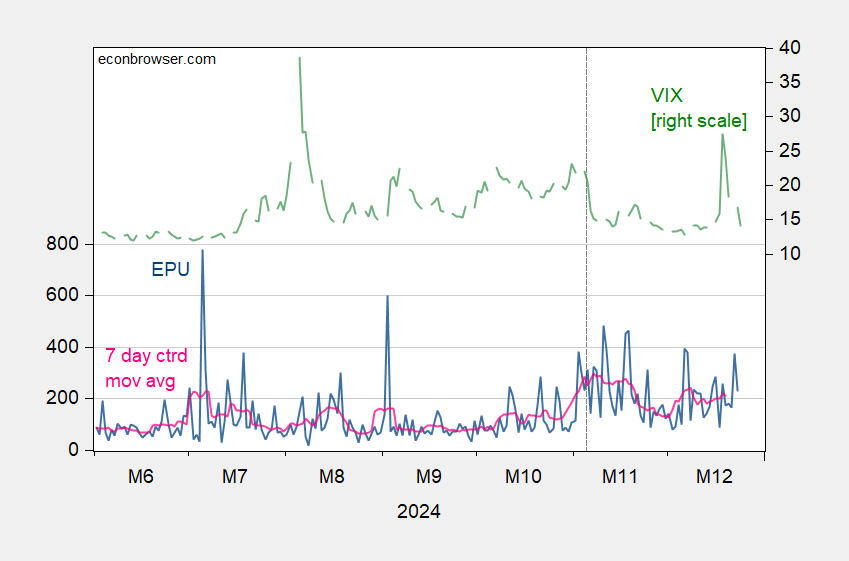

Certainly, uncertainty has increased since the election, relative to the recent past.

Figure 3: EPU (blue, left scale), EPU centered 7-day moving average (pink, left scale), and VIX (green, right scale). Source: EPU, CBOE via FRED, author’s calculations.

People voted for this (well, at least a plurality did), so here we go…